Hi and welcome to our presentation on humanism and client-centered theory, presented by Tatiana Daughtry, Shelly Carbo, and Jacqueline Lo. We will begin this discussion by talking about the origins of humanism and client-centered theory. The theory was created and developed by psychologist Carl Rogers, a very well-known psychologist in the 1950s, 60s, 70s, and 80s. When he passed away, he developed this theory because he believed that professionals should involve a more humanist approach in their practice. He acknowledged the self-worth of every person and believed that fostering a non-hierarchical, trusting, professional, and warm relationship between client and therapist was important. You might be wondering, what exactly is this theory? Well, it focuses on the context of a professional relationship grounded in trust. It's non-directive. The professional does not hold the power in client-centered theory. Instead, the therapist acknowledges that the client knows what is best for them. As such, it values the self-determination of the client. If you're wondering why, if the client knows what's best for themselves, do they need a social worker? With client-centered theory, the social worker is someone who empowers the client without being authoritative, offering support, and fostering that trusting relationship. There are three main practice principles to client-centered theory. Number one is that personal and social problems occur when people feel devalued. Number two is that change happens in the context of an authentic helping relationship. And the third is that people are capable of self-actualization when the conditions allow positive growth and change. People are naturally inclined towards growth and change. In essence, this theory capitalizes on what Carl Rogers believed was the inherent worth and dignity of each person. Client-centered theory is applicable in many different practice settings. It could be utilized in different educational settings, in domestic violence shelters, working...

Award-winning PDF software

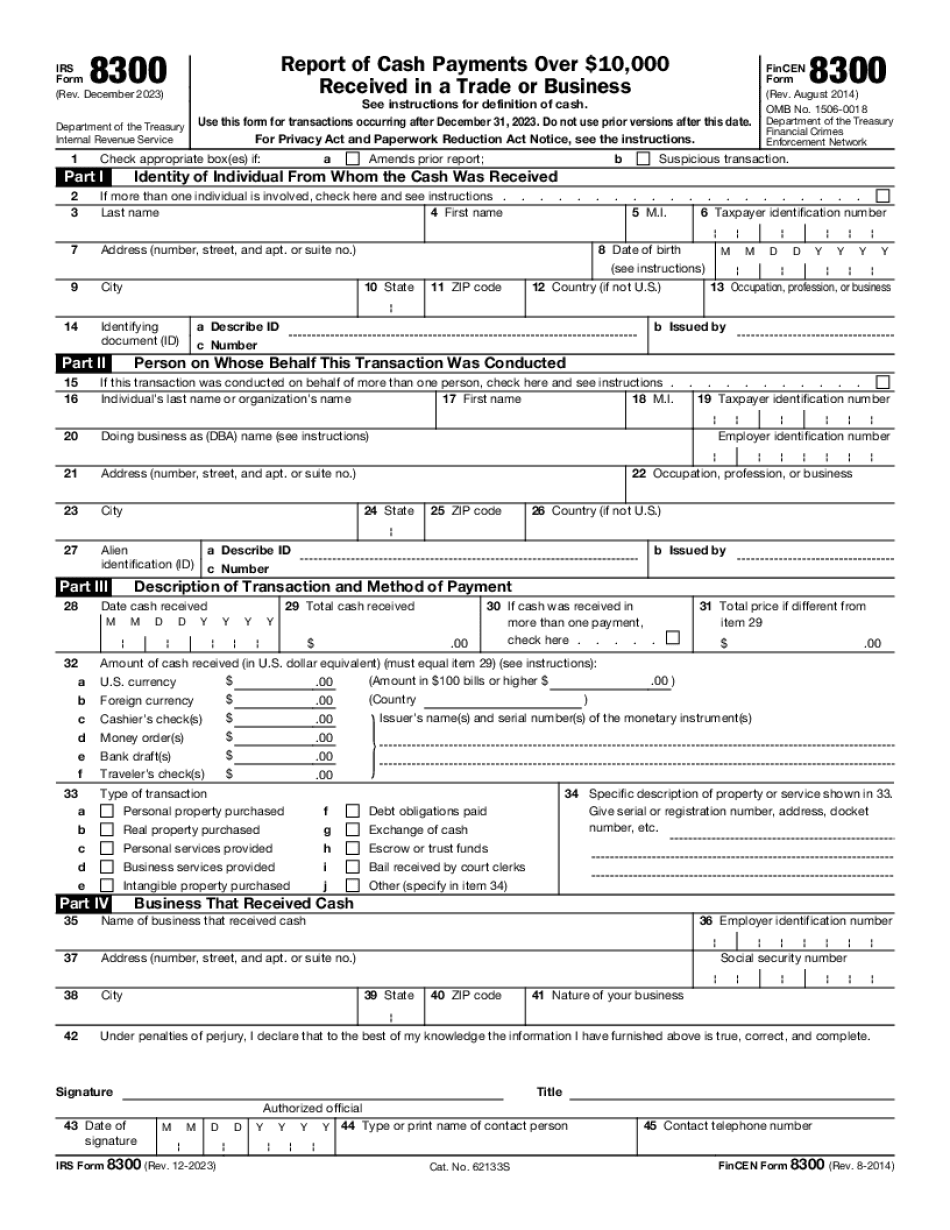

What happens if a 8300 is filed on you Form: What You Should Know

Income Tax Forms Mar 27, 2025 — All your tax forms. For individuals, filing Form 1040, W-2, 1040A. 1040A, 1040EZ, and 1040ETN for businesses. If you do not have an FSA # your tax forms will be mailed to you. If you use E-file or do not have an FSA # on file, you will be required to send a copy of them to the IRS. If you are under the age of 25 and have any question on the income tax or how to file a Form 1040 you are encouraged to contact the nearest IRS Service Center during regular business hours. If you are under 21 there is a 130 filing fee you may pay at the time of filing. This fee is refundable with the 541NR, and is deducted from your refund. This form does not have to be signed by the IRS, but it can be. IRS Form 1040, Payment of Filing and Interest Expenses | IRS Form 1040 is one of many forms used to report your income to the IRS. However, IRS Form 1040 is different from most other forms in the fact that it is used to report income from cash payments. The purpose of Form 1040 is to help the IRS determine if a taxpayer is required to file a Tax Return based on his or her income. As soon as you receive money with the intention of paying it to another individual or businesses there is a possibility that you are not reporting in accordance with IRS law. It is crucial that the IRS knows what you do with your money. The IRS can then use this information to determine if you are required to file a Tax Returns based on your income. A cash transaction would be considered income and therefore be required to file a tax return. A cash transaction is just as important if you are paying off a debt with the taxpayer receiving the money in the form of cash. Cash transactions are more than just one-sided cash trades or payments. Cash transactions also include transfers of cash between various persons, companies, banks, etc. and other types of transactions in which your cash (or something of value) is included by one individual or business and then is immediately distributed among the people involved.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8300, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8300 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8300 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8300 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing What happens if a Form 8300 is filed on you