Good day, everyone. Thank you for joining us. As Sam explained very well, we're going to spend a couple of hours talking about a new form. So without a doubt, you're pretty excited about today's program. Obviously, though, this is an important responsibility under the Bank Secrecy Act. We file 12 to 13 million currency transaction reports every calendar year. It's a responsibility that is significant for your institution and probably a number of your employees. One of the things I think you should be thinking about as we work our way through the new form is how you're going to conduct training among your staff members. Some of you may already be using the form, while some of you may have decided to make the switch from paper to the new electronic form 112, skipping the middle generation of the electronic form 104. In any case, we're going to go through a series of slides, as Sam said. I hope you did print those out so you can take some notes if necessary. You also have a copy of the demonstration form and the new form 112, I hope you've printed that out as well. As for the instructions, my suggestion would be to keep them in electronic form and develop a habit of using them that way because they're a lot easier to search. In any case, if you've got it in front of you, I will make some references to those as well. This is the new BSA CPR, also now being called the Fencin CPR. This is in comparison to what is now called the legacy forms, the earlier version of the electronic forms. But in any case, the current version of form 112 does not mirror the old versions of the currency transaction report. It is substantially different. It...

Award-winning PDF software

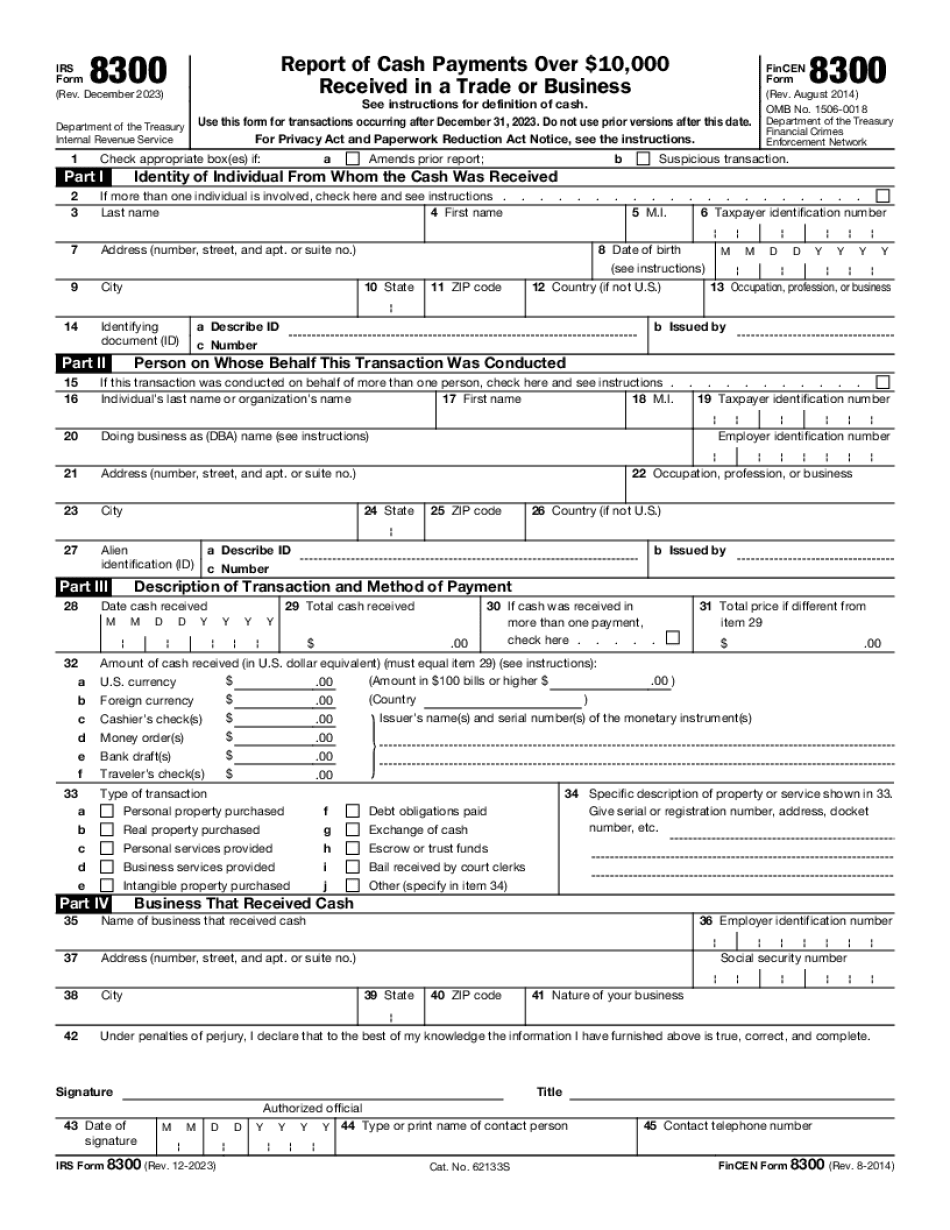

8300 wiki Form: What You Should Know

No longer effective: IRS Tax Reform of 2025 The BSA (Bank Secrecy Act) was enacted as Executive Order No. 13233 on April 24, 1970. Form 8300 — IRS The BSA also requires casinos with over 10,000,000 in gross revenues to report cash transactions totaling more than 10,000. Federal Reserve Statistic — USA. Gov As noted by Investopedia, one of the goals of the BSA was to increase the availability of financial data related to the operations and management of banks, savings associations, savings and loan associations and other institutions for the purpose of preventing, detecting, and deterring criminal frauds and money laundering activity. Form 8300 — IRS The Form 8300 is the “first step for determining whether a person is a legally resident alien” or “a nonresident alien.” The Form 8300 is one of numerous paperwork-based documents issued by the Internal Revenue Service (IRS) and required by U.S. financial institutions to determine a person's tax status. This form is primarily used to determine the residency status of an individual, but also is used to determine whether certain individuals may be required to file Form 1040, which is used to report personal income and deductions. Form 8300 is required in connection with the filing of any federal tax return. The IRS also uses this form to determine whether an individual may be required to file a Form 1040 form. Form 8300 is also a form that banks, savings and loan associations and other financial institutions must file if they hold U.S. assets in a branch (asset position) for nonresident aliens, nonresident aliens and their spouses or minor children, foreign persons (i.e., persons with permanent resident status) who are not U.S. citizens, estates of U.S. citizens or people with U.S. citizenship but with whom the individual does not have an estate, or nonresident aliens with respect to whom the Secretary of State has placed a notice of designation. Form 8100 — Bank Secrecy Act of 1970 — Wikipedia Form 1040 is a government-issued form that a taxpayer submits to the Internal Revenue Service (IRS) to report income and other expenses, or to report foreign income and deductions. Form 1040 forms are also typically filed by individuals and businesses who have employees, are self-employed, or own capital property.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8300, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8300 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8300 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8300 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 8300 wiki