The United States government, acting through the Department of Treasury's Office of Foreign Assets Control (OFAC), will target and designate individuals, businesses, or countries based on U.S. foreign policy and national security concerns. This designation can result in public humiliation and financial ruin. It is an economic warfare tactic that freezes the assets of the designee and seeks to limit their international trade and cut off all financial transactions subject to U.S. jurisdiction, both domestically and extraterritorially. Being placed on the list can feel confusing and unjust, as many people have no idea why they are targeted in the first place. Additionally, they may not know how to challenge the designation and may spend years going through incorrect channels such as the U.S. State Department, the Department of Justice, or even the United Nations or the European Commission. OFAC is responsible for administering the list, and it is where one needs to challenge their designation. Our law firm has experience in handling these matters and will challenge OFAC's designation in order to have individuals, businesses, or countries removed from the sanctions list. However, it is important to be patient, as this process can take anywhere from six months to several years. OFAC's focus is on designation rather than removal. The good news is that we understand how OFAC works and can work towards achieving the best result for you. It just takes the proper time and process. I'm Douglas McNabb.

Award-winning PDF software

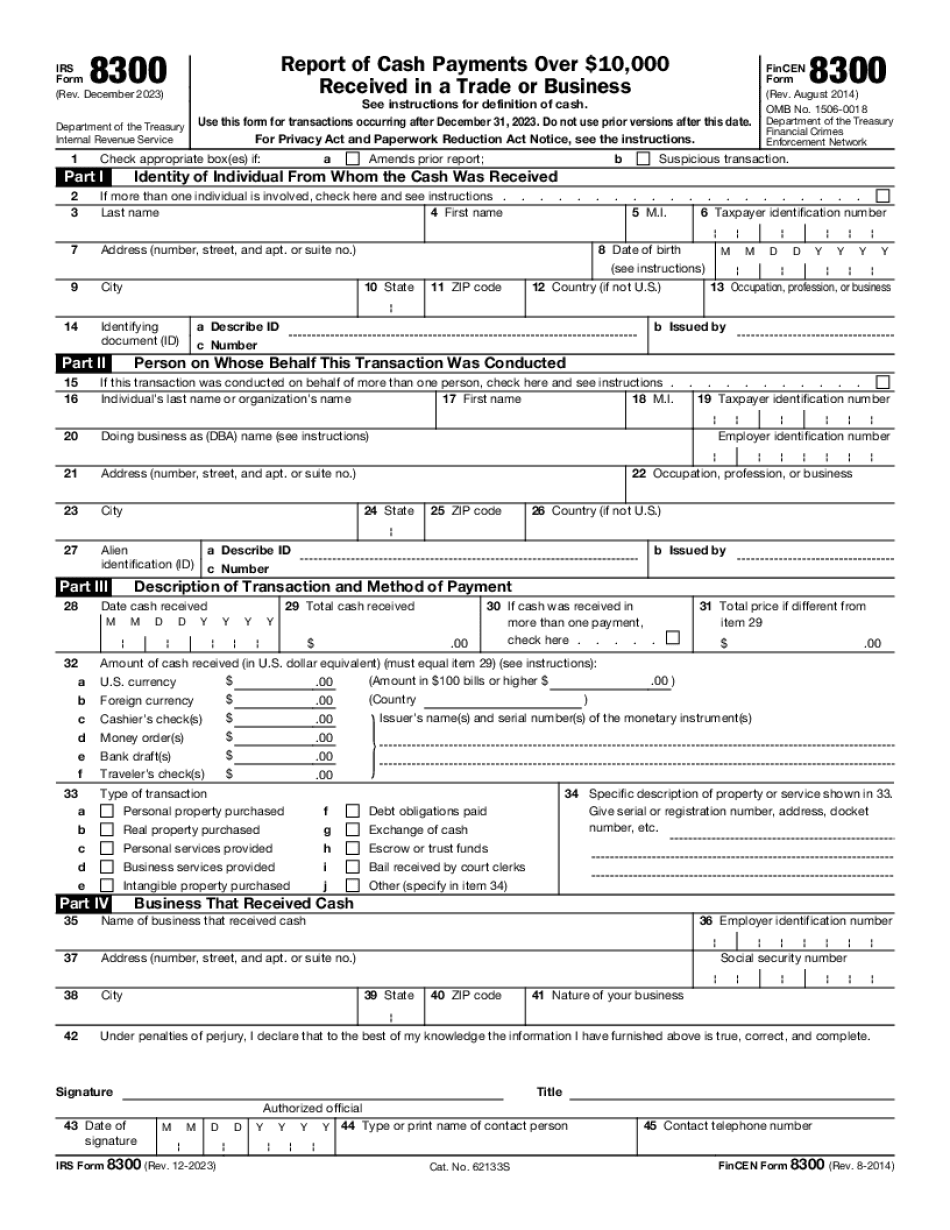

8300 penalties Form: What You Should Know

You are required to file Form 8300 — Civil Penalty — Community Tax If a person receives cash from any source, including a community or charitable organization, in exchange for services, a payment must be reported to the CRA. There is an IRS “minimum disclosure” requirement of 10,000 cash transactions. Form 990 Filing Report 2014 A Form 990 Filing Report is a return that is filed by a tax preparation company, or other entity, to disclose information regarding the company's tax returns submitted each year. The IRS has the authority to investigate whether a form is filed in accordance with regulations and in such case may fine, suspend, or revoke the person's certification to do tax-related business. For tax credits and tax credits which are tax credits under both the Code, and the tax treaty between the U.S. and the country in question, and which are claimed in any year, a Form 990 Filing Report is required to be filed annually. Form 990-PF is Form 990 Tax Report for Certain Business Entities Form 960 is Form 980 and are each required to be filed with a United States Secretary of State to reflect a change in income or change in deductions or credits from prior years which require the report to be filed. Forms 5471 and 5472 are IRS forms for reporting the income, employment, or employment-related benefits or losses of self-employed individuals who file their income tax returns jointly. Form 8331 is Form 8336F and is required to be filed with a United States Secretary of State to report information related to self-employment tax. VAT Reporting — United States of America The U.S. Department of Treasury's Bureau of Customs (Bureau) is responsible for administering the VAT (value added tax) in the United States. The Bureau may impose penalties as well as interest and may confiscate the tax return if it determines that the return did not comply with VAT regulations. VAT returns are filed by both individuals and small businesses. Forms W-2G 1040 and 1040A These forms are only for reporting wages and salaries paid to United States employees. These tax forms are typically used by people with offices located outside the United States. Forms 1099-MISC and 1029XB The IRS requires that 1099-MISC and 1029XB forms be filed with an Internal Revenue Service branch to report taxable income on wages made to nonresident aliens.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8300, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8300 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8300 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8300 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 8300 penalties