One of the best things you can do for your pruning tools is sharpening them. Like any cutting device, over time the blade will become dull and less effective. A file or sharpening stone may be used, or a sharpening tool like the AC 8300 from Corona, which is a carbide file that works on all metal blades and has a non-slip grip for added safety. For safety and better leverage, hold the tool with the blade facing you. Holding the file at an angle, with the edge of the file tip against the blade's bevel, make four to five passes over the cutting site. This will create some burrs on the non-cutting side, so turn the tool over with the blade facing away from you and make one pass with a file to remove them. It's simple, quick, and easy to do, and will keep your pruning tools working like new season after season.

Award-winning PDF software

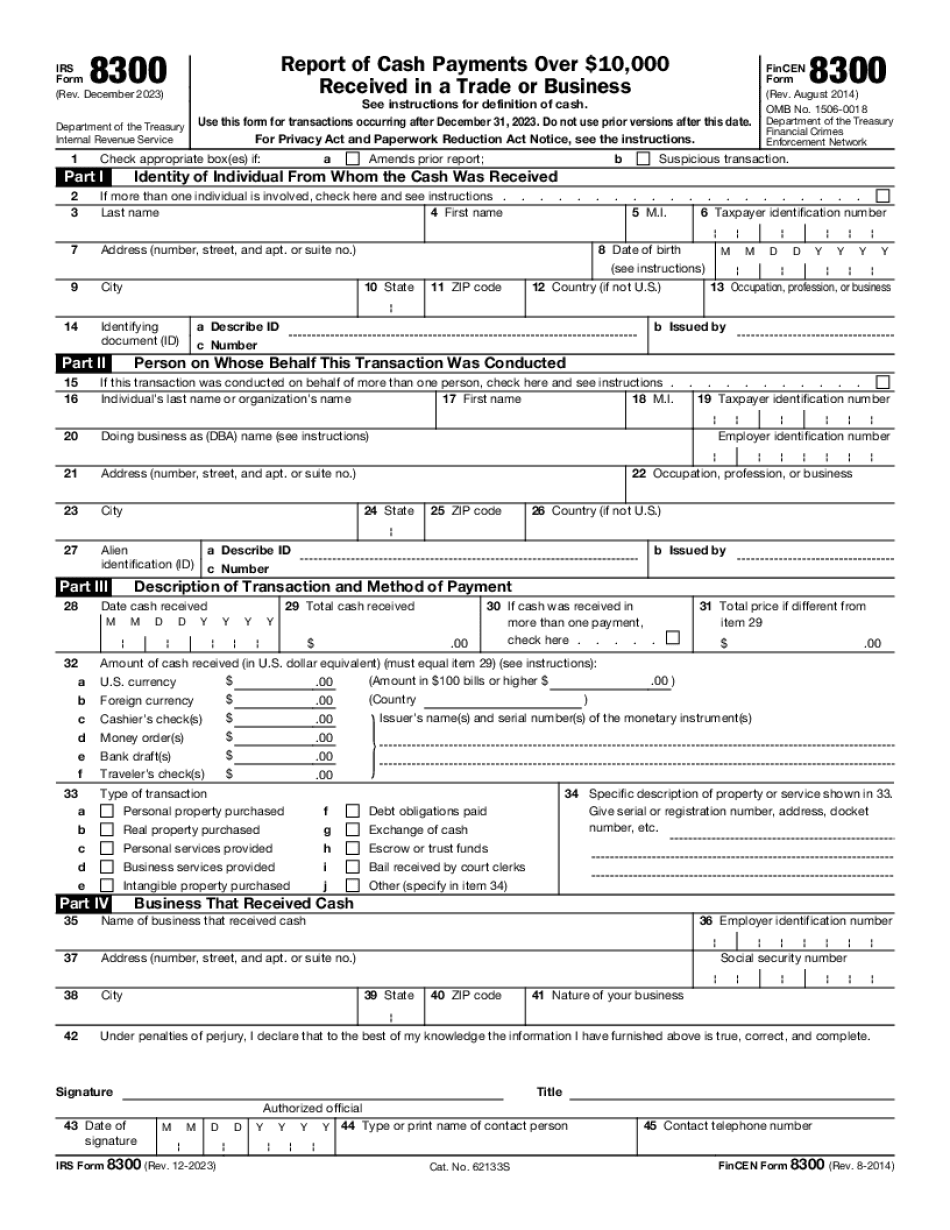

8300 instructions Form: What You Should Know

Filing Form 8300 — Free Money! Form 8300: Cash Payments of Over 10,000 in a Trade or Business — IRS There are a number of questions to which Form 8300 was designed to answer When you need to file Form 8300, it is strongly recommended that you complete and return a form called “Form 8300” before you send the form or check to the IRS. You know how many people are IRS Cash Payments Over 10,000 — IRS This is information that is not found anywhere else... IRS Cash Payments Over 10,000 — Free Money! This form reports the number of cash and noncash financial transactions in which the cash payment of over 10,000 is part of the transaction. All other payments are reported as Form 8300 — Payroll Expenses Form 8300 is required by the IRS when an individual or business receives any cash payment of over 10,000. IRS Form 8300— Payment for Goods and Services -- IRS This is a form that must be filed with the IRS when an individual or business receives any cash payment of over 10,000 when the payment is directly related to the transaction. It must have been for goods and services The individual or business also must provide information regarding a previous payment by the individual or business and the total amount received over 10,000 in the most recent transaction. Fin CEN's Cash Payments of Over 10,000 — Fin CEN There are four basic requirements for the cash payment form to be accepted These forms are for use with the “Free Money” tax debt relief program of the IRS.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8300, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8300 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8300 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8300 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form 8300 Instructions