Award-winning PDF software

Bank secrecy act regulations Form: What You Should Know

Sets forth the requirements to maintain anti money laundering programs. Fin CEN Form 105 In accordance with 31 CFR §103.1, this form shall be used to record all financial transactions for which the transaction must be reported when conducting business in the United The Bank Secrecy Act (BSA) requires banks to make certain records that are kept or obtained to be, and to be maintained in such form, and by such person, which will provide reliable evidence of, transactions required to be reported in section 641(a)(2) of title 31, United States Code. (U.S.C. 5311) In this release are a series of Bank Secrecy Act and related financial reporting requirements that apply to U.S. financial institutions that conduct business with money transmission businesses on a branch-to-branch basis. The BSA requires each bank holding company that was a national bank or Federal Savings Association during periods other than December 31, 1980, and before December 31, 1981, to file the following information with Fin CEN as specified in 31 C.F.R §103.23. For any U.S. financial institutions that were a national bank or Federal Savings Association during the time period other or subsequent than 1980, each such bank holding company shall file this information with Fin CEN by the due date prescribed under any applicable regulations or orders issued by a U.S. district court (or, for the District of Columbia if no such judge has been appointed, by the date of the issuance of a written order by the Secretary of the Treasury). Additionally, each bank holding company that was a national bank or Federal Savings Association on December 31, 1981, shall file an amended report with the Fin CEN as required by 31 C.F.R §103.23(c)(2)(B) by filing such amended report on or before the due date prescribed under the regulations or orders issued by a U.S. district court (or, for the District of Columbia if no such judge has been appointed, by the date of the issuance of a written order by the Secretary of the Treasury). In addition, the bank holding companies shall file this updated information by January 31 of each year. U.S.

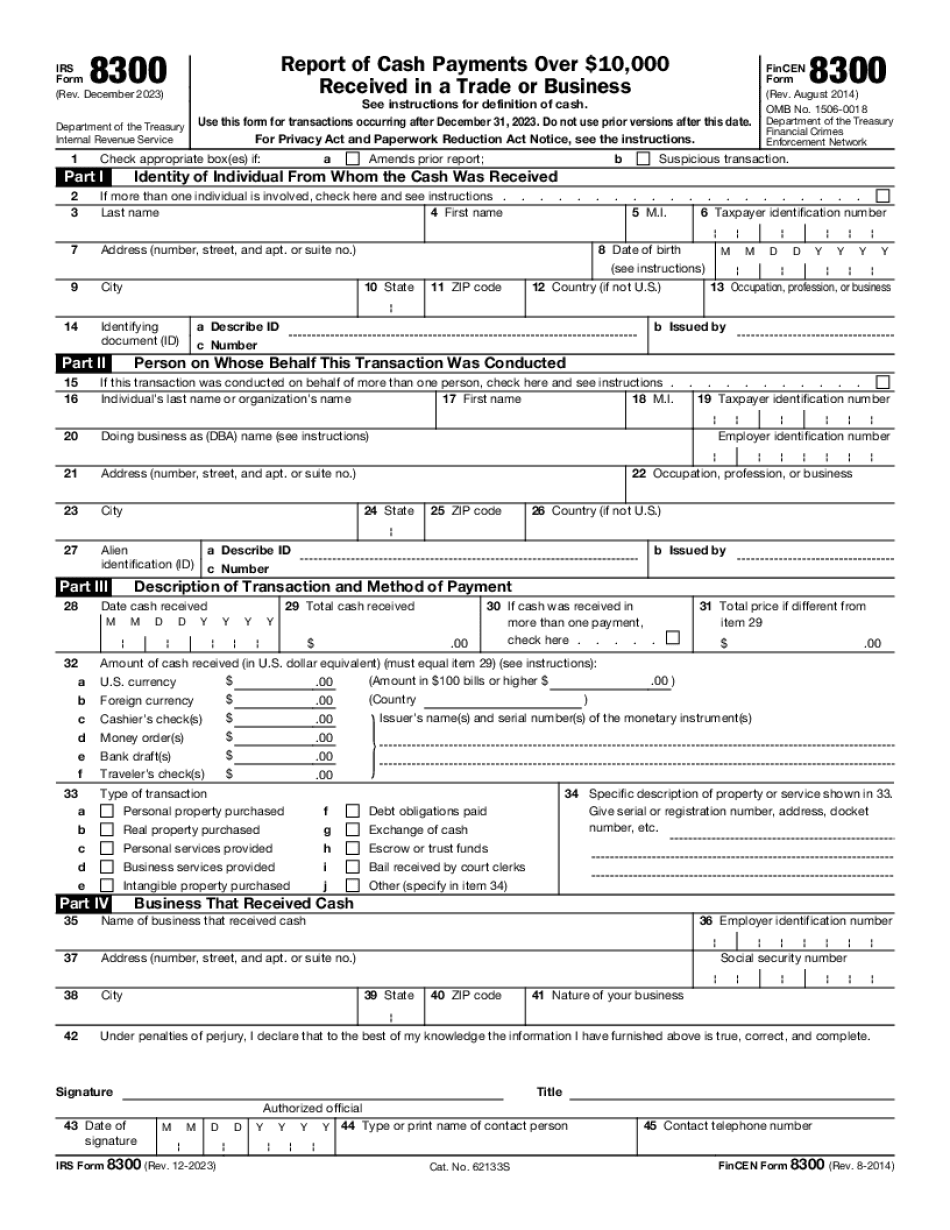

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8300, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8300 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8300 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8300 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.