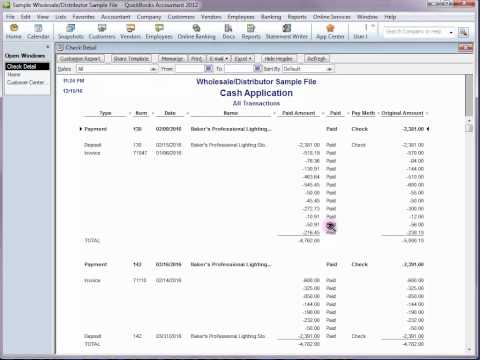

This is a recent McKenzie advanced certified QuickBooks ProAdvisor with a QuickBooks accountant time-saving trick. How to create a report that shows which invoices multiple payments were applied to, also known as the cash application report. The easy way to quickly see where a check was applied is to highlight the check at a list and then press Ctrl + H, and this opens the transaction history. I really like this handy little trick because you can do a couple of cool things from here. You can open the original transaction by selecting the "Edit payment" button. You can also go to one of the invoices here by pressing the "Go To" button. Additionally, you can print a report, and here's that report all nicely formatted and ready to be sent out. But what if you need to see multiple payments at the same time? There is not a pre-designed report in QuickBooks for this situation, but I'm going to show you how you can quickly create one. Now, there are two reports in QuickBooks that will show the link between transactions, and we can find those under the banking section of the reports menu. They are the deposit detail and the check detail report, and we are going to modify the check detail report to get what we need. In QuickBooks Accountant 2012, the "Modify Report" button has been renamed to "Customize Report," so I'm going to click that. The first step is to scroll down the columns and select the paid status and pay method. Next, I'm going to click the filters tab and change the account filter to "All Accounts." I'm going to remove the amount filter and change the date filter to the date range that I need. I'm going to change the transaction type to "Payment" and the...

Award-winning PDF software

Cash reporting requirements for banks Form: What You Should Know

In addition, banks and other financial institutions must report cash transactions in currency with a value of 10,000 or more by January 31 of the reporting year. Cash Transactions are Required to Be Reported by the 15th Day After the Day the Cash is Received Under the reporting procedures on this website, any bank in the US that has a branch office is required to file Form 8300 with the IRS by January 15, 2022. If your bank does not have a branch office in the US, the deadline is Feb 1, 2021. The bank must also report all of these transactions on Form 1099-B. If the cash transaction has a value of over 10000, this information must be added to the bank's Form 1099-B filing.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8300, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8300 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8300 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8300 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Cash reporting requirements for banks