Award-winning PDF software

Ann Arbor Michigan Form 8300: What You Should Know

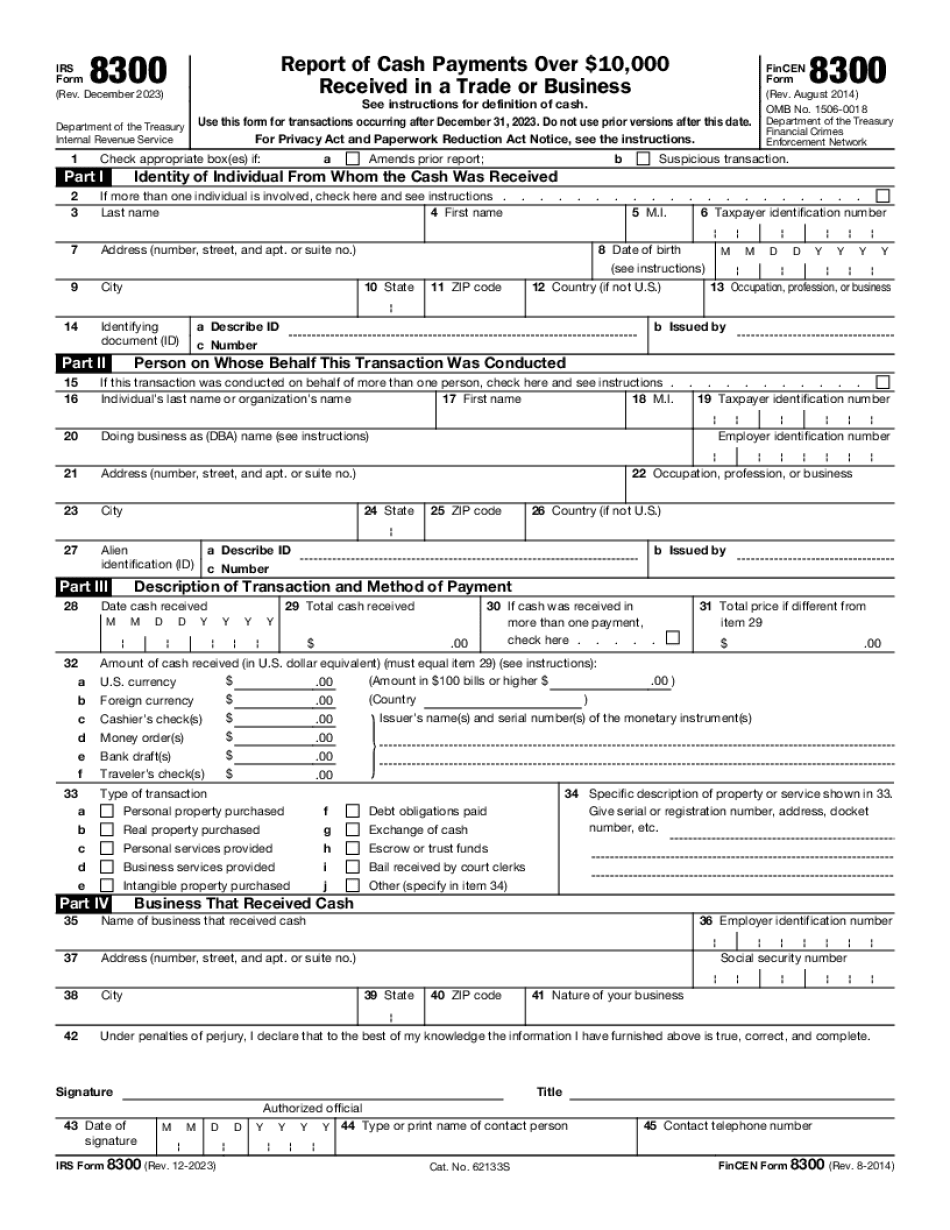

Department of Licensing and Regulatory Affairs/Office of the State Superintendent of Public Instruction Michigan Department of Health and Human Services Cannabis businesses are not obligated to report all cash payments, but businesses should take care to report all cash payments that exceed 10,000, as the cash payments may trigger the requirements of Michigan's new cash reporting requirements. Also, if an individual or business wants to report cash payments of less than 10,000 in a business, you will need to complete and file a Form 8300 and forward it to the Department. The state expects to have all forms updated later this fall. In August 2016, the state passed the “Marijuana Legalization Implementation (MAIM) Act, which changes the reporting requirements for cannabis businesses with a gross amount of more than 1,000 of cannabis sales within the prior 60 calendar days” (Michigan Dept. of State, May 23, 2018, ;). Marijuana businesses will be required to prepare and complete and file annual cannabis sales reports with the Michigan Department of Revenue (FOR). Under MAIM, the following entities are required to complete monthly reports for cannabis businesses: 1. Cash transacting businesses that process more than 10,000 in cannabis sales. 2. Cash transacting businesses that process between 50 and 999 in cannabis sales. 3. Grow houses. 4. Retail marijuana establishments. 4. Marijuana cultivators and processors. 5. Licensors. 6. Businesses with a gross sales value that exceeds 4,500 per month. (Michigan State Dept. of Treasury, July 14, 2016, ;). The new legislation also requires the department to compile an inventory of cannabis tax proceeds that will be used to fund state educational programs. The state is also required to provide a final report on the results of the 2025 cannabis taxation referendum to the voters in the fall of 2018. To be eligible to file Form 8300, the organization must be a Michigan cannabis establishment and the individual or business must be a resident of Michigan in good standing. The registration does not need to be renewed. “Businesses may file one Form 8300 every one to two calendar years.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Ann Arbor Michigan Form 8300, keep away from glitches and furnish it inside a timely method:

How to complete a Ann Arbor Michigan Form 8300?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Ann Arbor Michigan Form 8300 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Ann Arbor Michigan Form 8300 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.