Award-winning PDF software

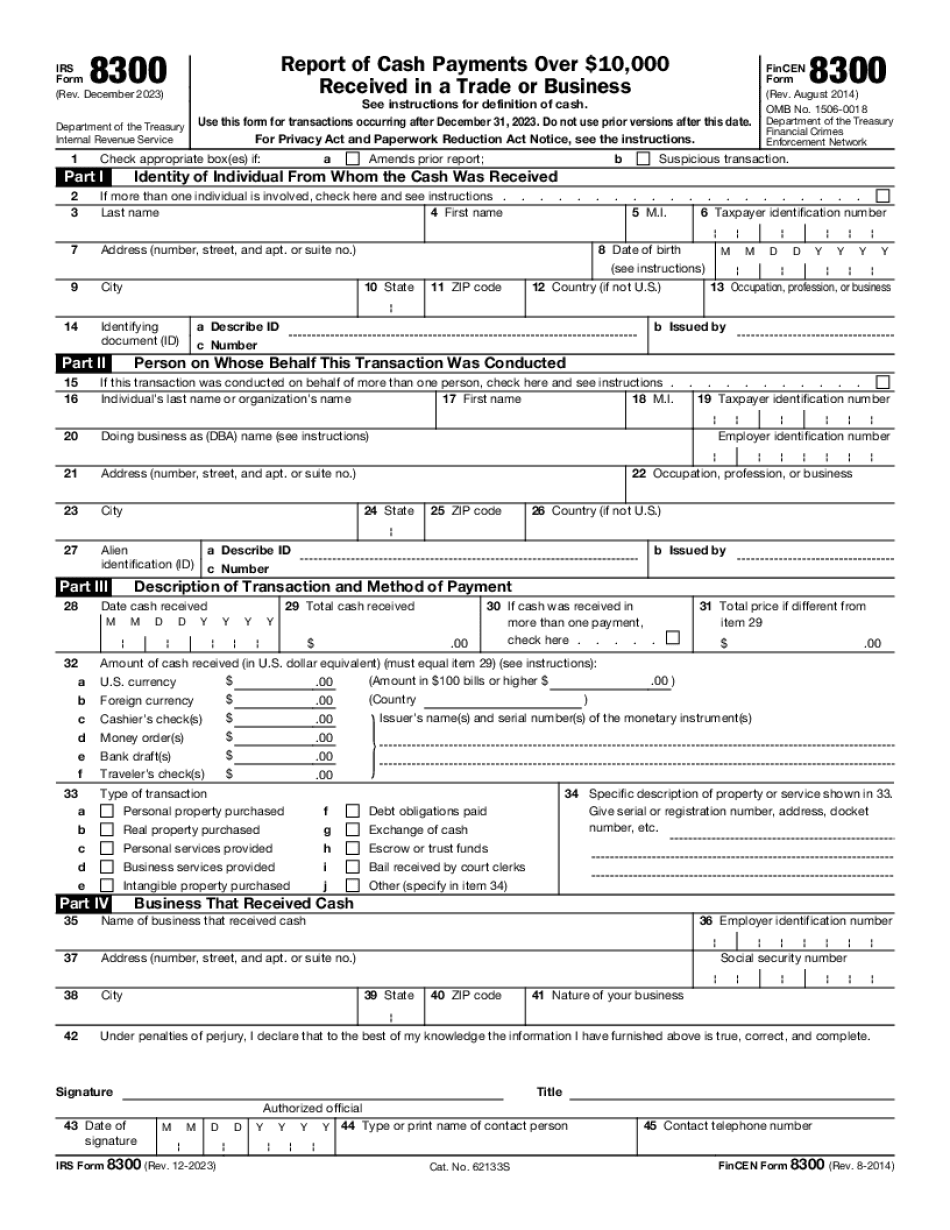

Aurora Colorado online Form 8300: What You Should Know

Tax Exempt Sales Tax Return — University of Colorado Boulder We have completed our work in developing the 2025 Colorado Revised Statutes, Chapter 14-3. As of the date printed, it is the new effective date. If you are not currently using a computer, download the PDF version of chapter 14-3 and read Chapter 14-3, Statutes of Colorado 2017. This is the new 2025 Colorado Revised Statutes and will be in all editions of the Colorado Statutes for printing. If you want to have your 2025 Colorado Revised Statutes to the computer, you MUST download the 2025 Colorado revised Statutes, Chapter 14-5, and read it on a computer! If you download the PDF version, please email taxesauroragov.org. Sales Tax — Aurora Sales to the federal government and state and local governments are exempt from tax in Colorado if they are delivered by a licensed or certified agent. If your state requires a certified or licensed agent for a sales to a government agency, please email salesauroragov.org. Sales Tax — Aurora Under Section 10 of Colorado Revised Statutes An employer of a salesperson for personal services who delivers the services to a purchaser at the location specified in the sales contract or other agreement on which the salesperson charges the purchaser a commission shall not charge the purchaser sales tax when the commission is determined on the basis of a dollar or percentage commission basis. Sales Tax — Aurora Sales to the federal government, the Colorado Department of Revenue and the city of Aurora, their departments, institutions and political File Aurora Taxes Online Sales Tax Exempt Under 11A-9-501, a seller of tangible personal property may deliver it to an unlicensed person or person not entitled to be licensed and with no license or registration required to have the property on his person when delivered to and received by the unlicensed person or person. Section 11A-9-501.1 — “Dealing with unlicensed sellers; delivery to unlicensed person or unlicensed person not entitled to be licensed.” Sales Tax Exempt Section 34-14-102, the sales tax exemption for a seller of tangible personal property is limited to a small amount of sales tax. Sales tax shall be paid by the buyer of the tangible personal property in accordance with subsection A-7-100. The tax for delivery shall be the amount of sales tax actually and reasonably paid upon the tangible personal property.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Aurora Colorado online Form 8300, keep away from glitches and furnish it inside a timely method:

How to complete a Aurora Colorado online Form 8300?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Aurora Colorado online Form 8300 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Aurora Colorado online Form 8300 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.