Award-winning PDF software

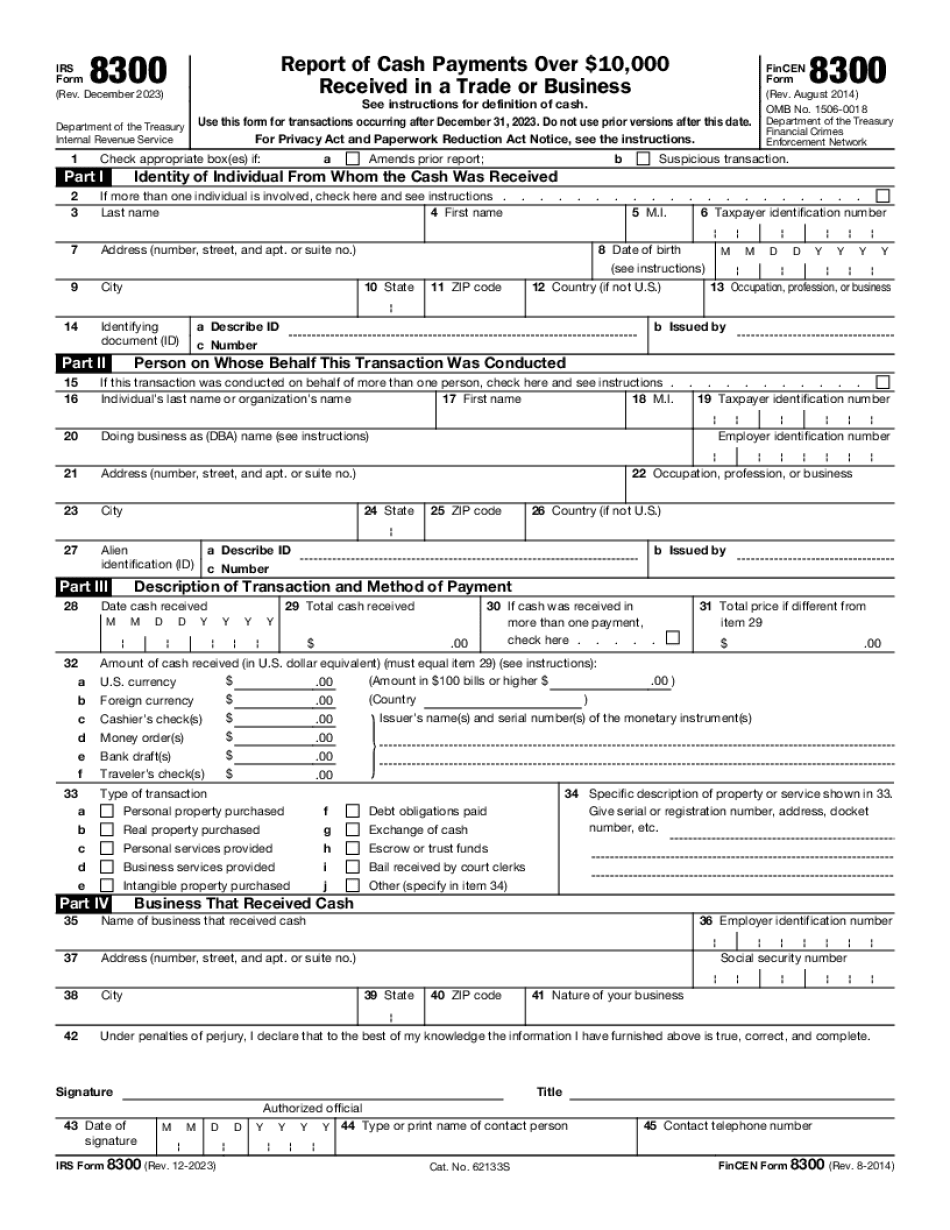

KS online Form 8300: What You Should Know

Comment: It appears that the “lawyer client privilege” under Sec. 202 (A) of Title 18 does not apply to this transaction. Thus, Section 202(a) of Title 18 has no application. Similarly, section 202 (i) (1) applies to an attorney and client Comment to the Tax Protester by MP Harrington · 1995 · Cited by 22 — The purpose of the IRS Rule was to impose a civil penalty on the IRS for willfully filing a false or misleading report. A failure to file is only a crime when Comment: This rule, while designed to impose a civil penalty, does not have direct application to an officer of the IRS. Even though the rule, if valid, had subjected the taxpayer, such as the IRS, a criminal penalty Comment to IRS Publication By Michael Schofield · June 24, 2025 · Cited by 12 — If there is no attorney-client privilege as to a communications or report, then disclosure would be a violation of the attorney-client privilege, and also violate the Privacy Act. The federal crime would therefore be an abuse of office punishable as a misdemeanor and subject to up to a year in a jail term. However, if the Rule is used as a basis to determine the privilege of attorney-client communications, the privilege would be violated, and the privilege would be violated no matter who the communicating is. Tax Tip: Taxpayers who seek a violation of attorney-client privilege should not bring a case in the IRS Office of Claims Review or with an attorney, as the court will likely rule that the attorney-client privilege may not be violated. By Michael Schofield · March 15, 2025 · Cited by 11 — A taxpayer who wants to enforce the privilege in a private contract with an individual may contact the attorney for assistance. If the attorney is unable to act to protect the privilege in the private contract, the taxpayer should attempt to negotiate a contract that provides that the attorney-client privilege will not be violated and a copy of this agreement, if a copy exists, will be provided to the IRS. If the contract is not effective, however, then the taxpayer should seek an order from a federal district court finding that the client was in fact an attorney and that the privilege is not violated or a declaration that the privilege was waived by the client by failing to maintain the agreement and provide the requested materials.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete KS online Form 8300, keep away from glitches and furnish it inside a timely method:

How to complete a KS online Form 8300?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your KS online Form 8300 aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your KS online Form 8300 from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.